Why Payroll Software is Important for Increasing Company's Productivity

How Payroll Management System Works and How Can It Benefit Your Organisation?

Get seamless payroll management within your organization with Payroll Hub

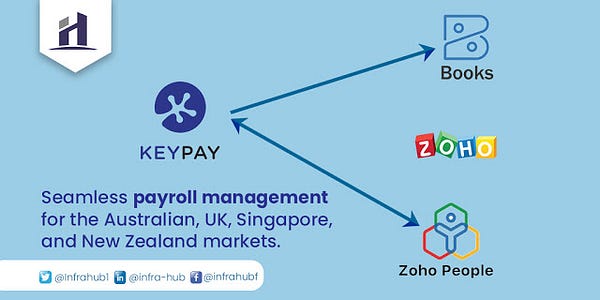

As Zoho Payroll offers limited features to Australia, United kingdom, Singapore, & New Zealand; Payroll Hub presents a Payroll Software that integrates Keypay with Zoho Books and Zoho People, and complies with Modern Awards & National Employment Standards of Australia

PAYROLL FOR ZOHO

Payroll Extension for Zoho Books

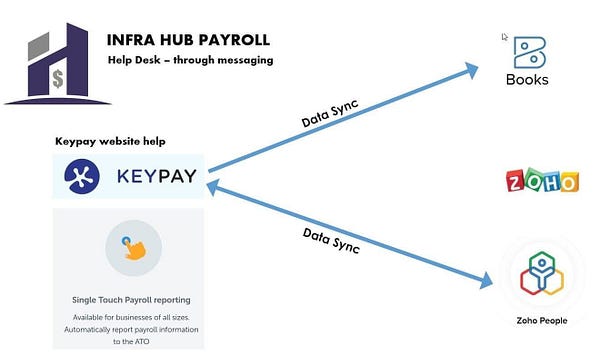

Payroll Hub integrates Zoho Books with KeyPay and Zoho People for efficient payroll management.

KeyPay is a cloud payroll software that tracks expenses, rosters, time-sheets, pay runs, and leave, with pre-built modern awards that help you stay compliant by automating all pay rate calculations for Australia, New Zealand and UK. Additionally, the employee self-service portal module allows the staff to submit leaves, view shifts, and create time-sheets through any device.

Zoho Books is an all-inclusive accounting software that records all your expenses, payments, and other financial data in one place. Zoho People, on the other hand, is a cloud-based HR software that manages your human resource needs such as attendance management, employee database and more. The sync with Keypay can be with Zoho Books or Zoho People or with both as required.

Know: how does Zoho connect with Payroll?

Payroll Hub is the ultimate stepping stone in remote work that ensures seamless Payroll Management by integrating Keypay with Zoho Books and Zoho People, particularly built for the United Kingdom, Singapore, New Zealand, & Australia markets.

Payroll Hub is a cloud-based, centralised Zoho Books extension that integrates with KeyPay and Zoho People if required to manage all things related to your organisation’s payroll management. Payroll Hub can help streamline your entire payroll processes and keep track of pay runs, travel expenses, time-sheets, employee reimbursements, attendance, and more from one place. Added to this, the integration comes with an employee self-service portal that allows staff members to directly manage their leave, expenses, and time-sheets.

Are you looking for Zoho Payroll in Australia, Zoho Payroll in United Kingdom, Zoho Payroll in New Zealand and Zoho Payroll in Singapore or any other country?

If you are looking then Get the Payroll Extension for Zoho Books

Key Features of the Payroll App

Payroll Hub includes a white-label Keypay account and integrates with Zoho Books and Zoho People.

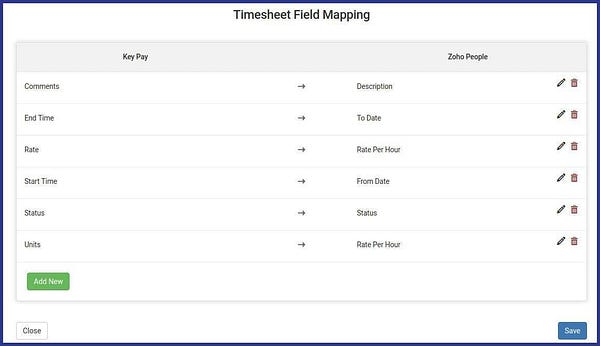

Effortlessly sync various Zoho People modules with KeyPay like Employees, Location, Leaves, Time-sheet, and Expenses. You can also sync your Journal data from KeyPay software with Zoho Books by selecting the organisation and journal account. Also, timesheets from KeyPay can be synced to Zoho People to enable automatic invoices of clients.

Payroll Hub includes a “white-label” account to KeyPay (for Australia, NZ and UK) so no need to pay for that separately per user.

- Employee Details

- Employee Leave

- Employee Rosters

- Employee Expenses Module

Payroll Hub app easily customises the mapping between Keypay and Zoho Books and/or Zoho People.

Do you need Zoho Payroll Extension for Australia, Zoho Payroll Extension for United Kingdom, Zoho Payroll Extension for New Zealand and Zoho Payroll Extension for Singapore or any other country?

You can get it here PAYROLL FOR ZOHO

Here’s How Does Zoho Connect With Payroll? Payroll Management Software

KeyPay Access control ensures that only the authorised people within your organisation see the payroll information. Depending on roles and responsibilities of individuals in your organisation, the level of information can be modified as required.

KeyPay offer the use of a secure server. All supplied sensitive/credit information is transmitted using the latest 256-bit Secure Socket Layer (SSL) encryption technology and then encrypted into their payment gateway provider’s database only to be accessible by those authorised with special access rights to such systems, and are required to keep the information confidential. 256-bit SSL encryption is the industry standard.

Get Payroll Extension for Zoho Books

Also Read : Why you Need Seamless Payroll Management Within Your organization

Do you need Zoho Payroll Extension for Australia, Zoho Payroll Extension for United Kingdom, Zoho Payroll Extension for New Zealand and Zoho Payroll Extension for Singapore or any other country?

We know what you’re thinking. Most of us only speak one language. How does Zoho speak Payroll Hub? And how does Payroll Hub speak Zoho? We’d like to say ‘magic’, but our programmer’s wands were broken the day they wrote the code for Payroll Hub. So they used good old-fashioned scripting, and made a bullet-proof means of our payroll app getting data out of the Zoho People and Books modules, and putting the data in the right place. On time, every time.

Best Payroll Management Software for Businesses

Payroll Hub For Zoho Books and Zoho People with Keypay Integration

If you hire employees, you are responsible for collecting tax and Insurance from them on behalf of the government. While many businesses still maintain their payroll manually, this is time-consuming and prone to error. So, most SMEs’ best solution is to automate the process using specifically designed payroll software for small business.

Not too long ago, this wouldn’t have been affordable. But right at this point, given the wide variety of cost-effective SaaS-based cloud payroll software available in the market, it’s a realistic option.

Setting up the best payroll software for your business

Suppose your business is set up in the UK and seeking to handle payroll in a cost-effective manner. In that case, you will need to first register with HMRC (Her Majesty’s Revenue and Customs) beforehand and complete specific protocols in order to set up payroll.

Irrespective of what payroll software you’re going with, you’ll first need to register each person’s employment details into the system, including their tax code, which defines how much PAYE and National Insurance you need to deduct.

Then, just update an employee’s record with all changes to wages or salary paid and any holiday pay or other entitlement, and our advanced payroll hub for Zoho payroll management software will do all the necessary tax and NI calculations that comes pre-integrated with Zoho Books, Zoho People, and Keypay.

Choosing the best payroll software for your business

Deciding which is the best payroll management software for you will depend on various factors such as the size of your company, the level of technical support you require, the accounting software you currently use, and whether your staff is salaried, paid by the hour, or receive a commission.

However, here are some of the essential functions and standard features you should look out for.

· Real-Time Information (RTI). To give an up-to-the-minute and realistic view of taxes advanced and other deductions, RTI was introduced. Therefore, it is expected of everyone only to use payroll management software that is RTI compliant like those of Payroll Hub for Zoho.

· If you pay commission, bonuses, and overtime, look for a system that can be easily customized to your business needs. If your payroll rarely changes, a solution that offers automated rules and scheduling will allow you to carry the same processes every week or month with minimal effort.

· With most people paid through BACS (Bankers’ Automated Clearing System), you will want a payroll management solution that can carry out the mentioned functions, or you’ll have to set up a separate system to do so.

· Be informed that not all systems will print out payslips or send an EPS (Employer Payment Summary) report or EYU (Earlier Year Update) to HMRC. Again, all useful to have.

· UK businesses are now required to automatically enroll employees into a pension scheme and make payroll deductions accordingly. Hence choosing a cloud-based payroll management software that can auto-enroll new employees and manage pension payments and records will be another time-saver.

· If you need to access the system from mobile devices, then consider a solution that works across multiple devices. But make sure to check if there is any loss of functionality or responsiveness when using a smaller screen.

· Having a system with multi-user access is useful if you want staff to download previous payslips or look up their pay history, for instance.

· However, there’s always a learning curve when implementing new software, so you might want to consider significant technical and ongoing support from the vendor.

If you’re deciding on a solution for your business Payroll Hub for Zoho can help. Our team of expert consultants can help advise you on the payroll package that will work best for your business and even set it up.

Getting it right in the first place can save you a lot of headaches later. Select the Right Payroll Management Software for your Business

For more information, you can contact us or request a quote directly here.

Payroll Hub for Zoho is a comprehensive cloud-based solution from one of the best accounting software firms. It comes pre-integrated with Zoho Books, Zoho People, and Keypay for a full-featured payroll management solution.

You can even print or email your payslips and other reports to save yourself from all that paper clutter. It’s easy to amend former pay runs, and adjustments are handled automatically.

Try it free for 30 days; then, the standard pricing starts at £3 per month + VAT. Please note that all features are included even in the basic plan, and the prices can scale as and how your employee strength increases.

This article’s Payroll Hub for Zoho (Australia, NZ, Singapore and UK) , Best Payroll Management Software for Businesses in the UK originally appeared in Infra Hub Website

This is a great inspiring article.I am pretty much pleased with your good work.You put really very helpful information. Keep it up. Keep blogging. Looking to reading your next post. Bookkeeping Services in Vancouver

ReplyDelete